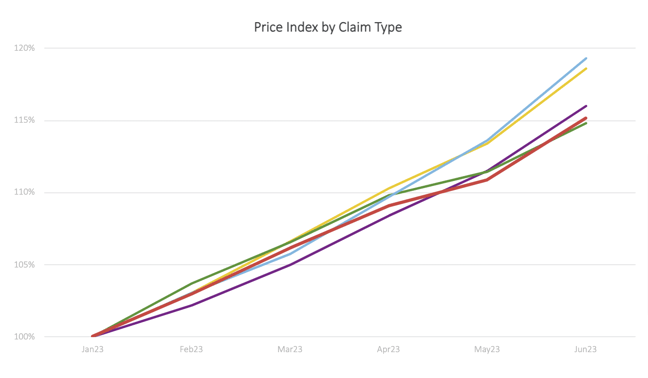

Home insurance companies are taking steps to safeguard themselves from rising claims costs. Peter, November 16, 2023March 7, 2024 Market Trends in Home Insurance In response to rising claims inflation, recent data from Consumer Intelligence suggests that the home insurance market is taking steps to safeguard itself. The surge in construction material costs, driven by various economic factors, has led to spikes in labor expenses and supply shortages for essential building materials like concrete and steel. As a result, home insurers are grappling with significant increases in claim and repair costs. Claim Type and Inflation Rates Escape of Water: +19.3% Damage: +18.6% Building: +16.0% No Claims: +15.1% Theft: +14.8%  A report by Go.Compare highlights water and damage claims as the most frequent in the home insurance sector in 2022. In the first half of 2023, those filing water and damage claims experienced higher premium hikes compared to other claimants and non-claimants. Market Response and Brand Strategies Interestingly, in June 2023, several insurance brands seemed to be shying away from claimants by offering lower quotes. Fourteen brands quoted significantly less for claimants, with two brands not quoting them at all. Additionally, 5 out of 6 brands that were competitive with claimants raised premiums more for them than for non-claimants. This indicates a strategic shift in the home insurance market to counter claims inflation. Actionable Insights and Tools To gain a deep understanding of market dynamics, competitor strategies, and brand positioning in the home insurance market, utilize Consumer Intelligence’s price benchmarking tool, Market View. Stay ahead of the curve and optimize your competitive position in this evolving landscape. Source: CI Market View (PCW Price Benchmarking). Sample Size: 2100 Risks Run Each Month Per PCW. Home insurance