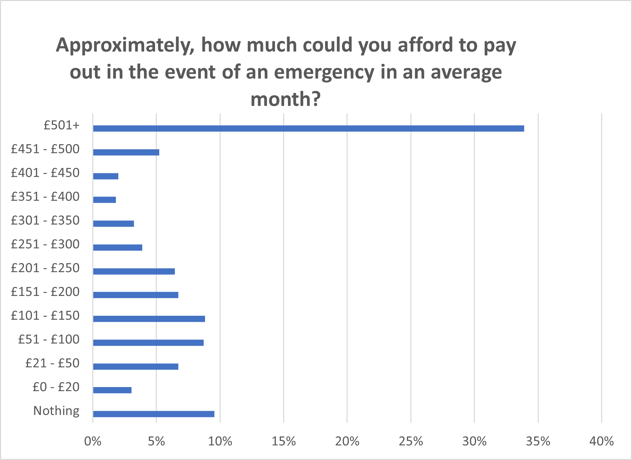

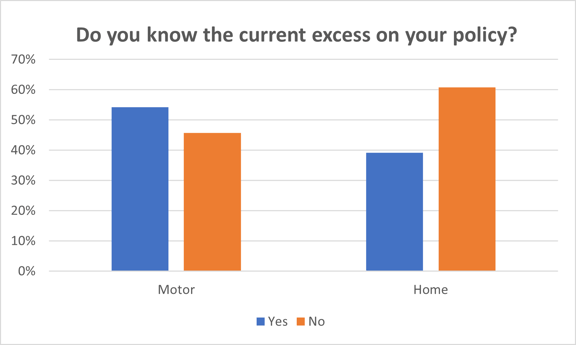

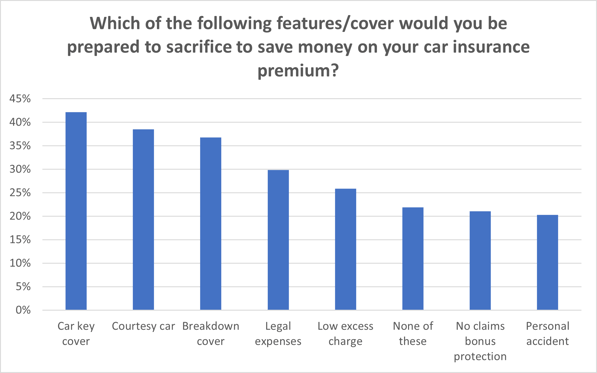

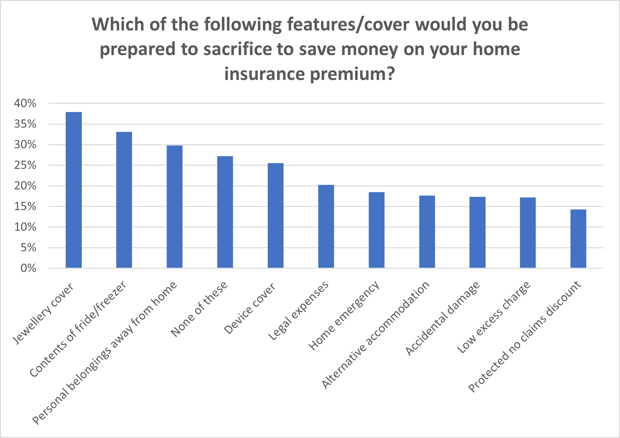

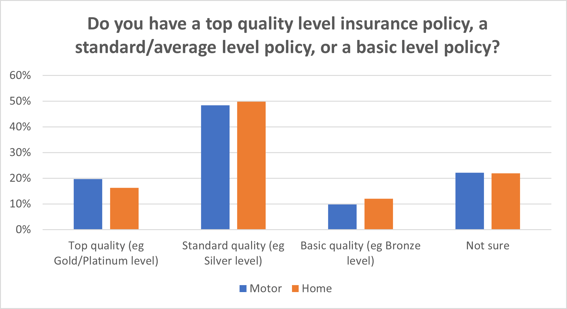

Could your tiered products lead to compliance issues with Consumer Duty regulations? Peter, November 21, 2023March 7, 2024 Customer awareness of general insurance products may be lower than many companies realize, particularly due to the increasing availability of tiered products that often reduce coverage and raise deductibles. A recent survey conducted by Consumer Intelligence in February, involving 1056 participants, revealed that knowledge about coverage levels and deductibles varied greatly among consumers. Surprisingly, more than 20% of insured individuals had no knowledge of the level of motor (22%) or home (21%) coverage they had purchased – whether it was top, standard, or basic.  When asked for more specifics about their coverage, a significant portion of car insurance customers (46%) and home insurance customers (nearly 60%) were unaware of the amount of deductible they had agreed to pay in case of a claim. Alarmingly, 15% of home insurance policyholders were unaware that their deductible could increase for certain incidents like burst pipes or subsidence, with 37% admitting they were unsure about their potential financial liability.   Catherine Carey, Head of Consumer Strategy at Consumer Intelligence, noted the rise of product tiers post the General Insurance Pricing Practices (GIPP) reforms, with brands introducing bronze/silver/gold versions to cater to different consumer budgets and gain an edge on Price Comparison Websites. Amidst these changes, it is crucial for firms to prioritize consumer education in light of the upcoming Consumer Duty, as indicated by the increasing number of individuals considering downgrading their policies for cost-saving purposes.  Notably, a significant portion of consumers expressed willingness to sacrifice key coverage features, such as legal expenses, courtesy cars, and breakdown cover, to lower their premiums, highlighting a gap in understanding regarding policy details.  Despite the cost-saving benefits, it is essential for consumers to fully comprehend the trade-offs involved in opting for lower-tiered products, as they may end up with insufficient coverage during emergencies. The findings underscore the importance of ensuring that budget insurance products offer fair value and truly assist those in need, in alignment with the FCA’s focus on consumer protection and vulnerability. Home insurance