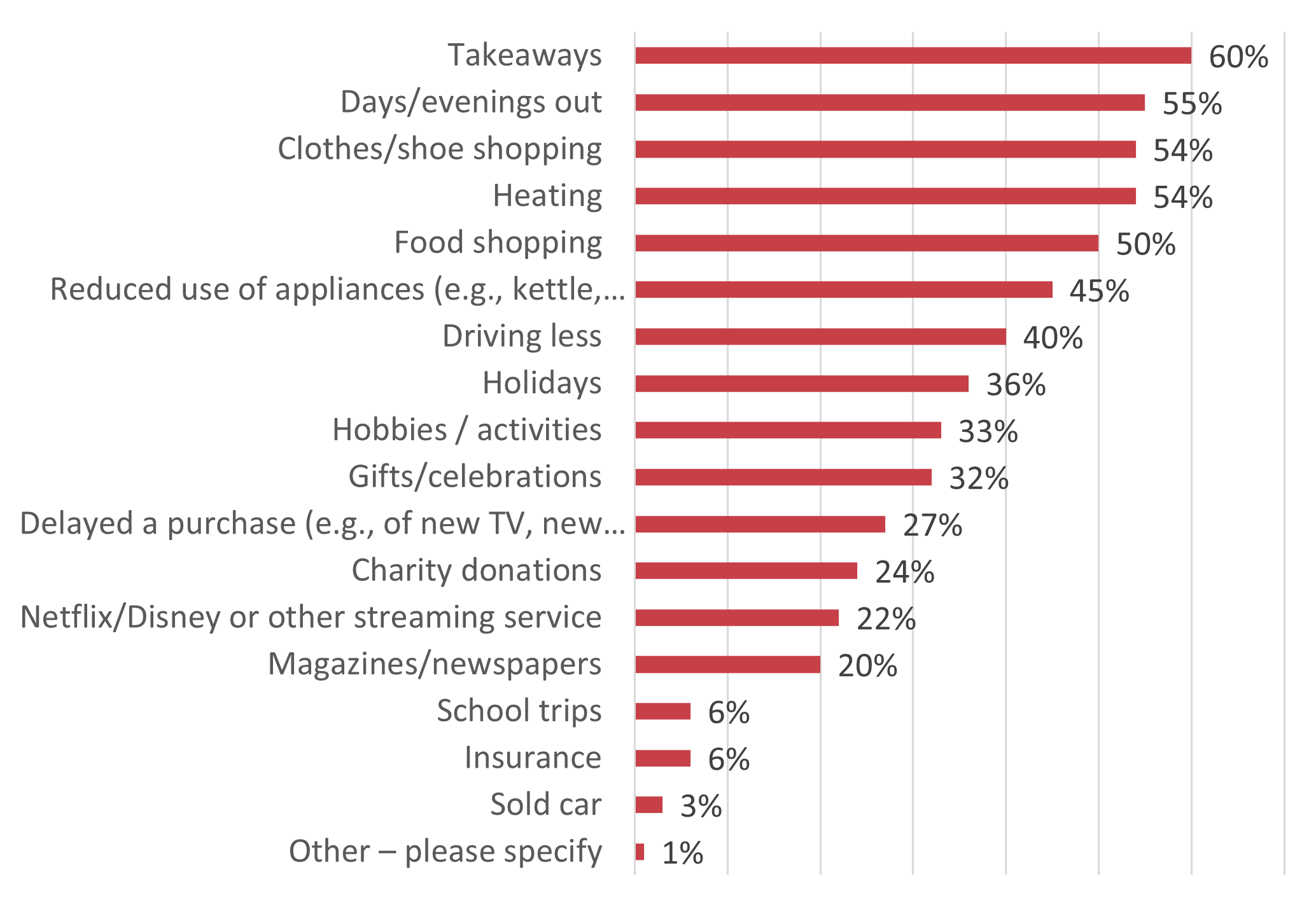

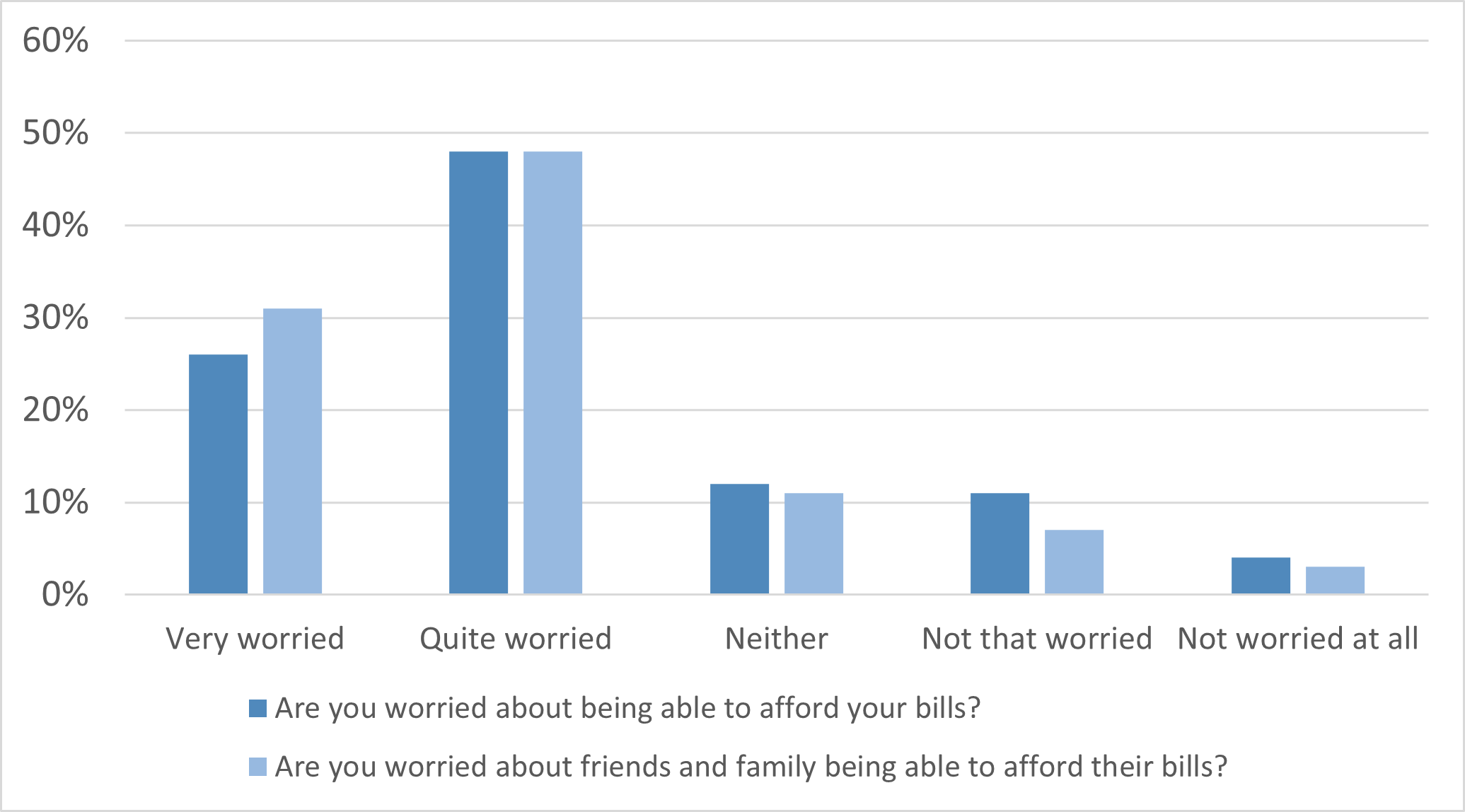

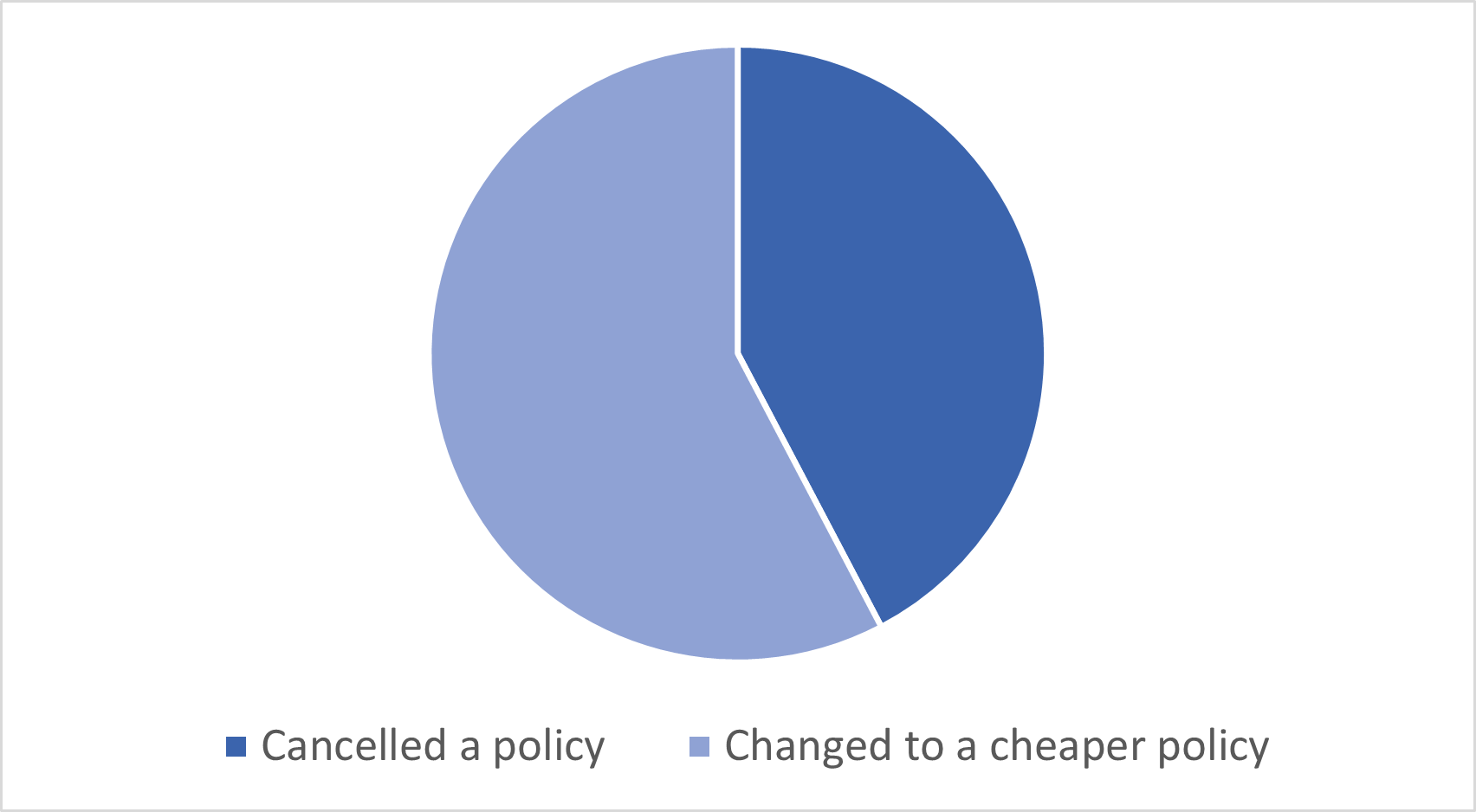

How will the rising cost of living affect insurance? Peter, December 7, 2023March 7, 2024 Cost of Living Crisis Impacting Households  The cost of living crisis has been making headlines for months. In April, a 54% increase in the energy price cap affected 22 million homes, resulting in an estimated £700 yearly rise in the average bill. Food prices and fuel costs are also on the rise, with the Bank of England warning that inflation may reach 10% in the coming months. For many households, especially the poorest, this situation is causing significant hardship. People are facing tough choices between necessities like heating and food. As people tighten their belts and watch their spending, they are looking for ways to save money. Survey Results: Financial Concerns A recent Viewsbank survey revealed that 66% of respondents are already feeling the financial strain, while 32% are aware but have not been affected yet. Only 17% of people are not worried about affording their bills. Concerns extend to family and friends as well, with many worried about their loved ones’ financial situations. Cutting Back on Expenses To cope with rising costs, people have started reducing their spending. Takeaways, dining out, clothes shopping, and heating are among the expenses that have been cut back on. Additionally, people are reducing food shopping, appliance use, and driving to save money. Focus on Insurance Interestingly, insurance is one of the least affected areas in terms of cutbacks in the past three months. However, as the cost of living crisis continues, more people may consider reducing their insurance expenses. Consumers are becoming more price-sensitive, with many opting for cheaper policies or cancelling existing ones. Actions Taken to Reduce Insurance Costs In the survey, it was found that pet insurance was the most commonly cancelled policy, followed by car insurance and buildings/contents insurance. Consumers are looking for ways to save on insurance premiums by switching to cheaper options.  Future Outlook As the cost of living crisis deepens, insurance providers need to be proactive in addressing consumer concerns. They should communicate the value of non-compulsory policies and offer flexible payment options to accommodate cost-conscious customers. Providers must prepare to support vulnerable customers as the crisis persists. Consumer Intelligence CEO Ian Hughes emphasizes the importance of insurance providers adapting to the evolving consumer landscape amidst the cost of living crisis. Stay informed with our latest insights and be prepared for the changing consumer behaviour. Interested in tracking consumer behaviour trends? Download our infographic to stay updated and be the first to access new data. Download the infographic  Share your thoughts on this blog post and explore topics related to home insurance, motor insurance, pricing, travel insurance, and consumer research. Connect with us on Twitter, LinkedIn, and Facebook. Home insurance