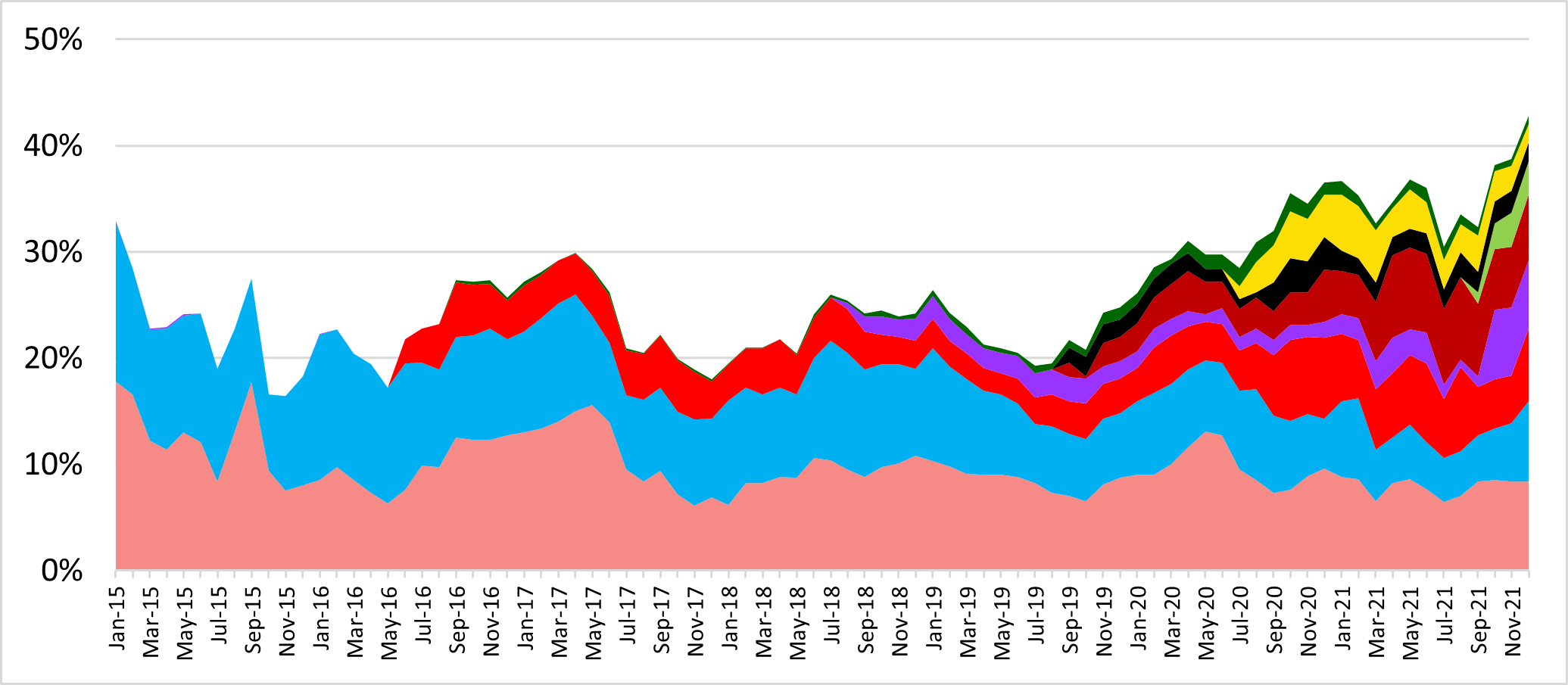

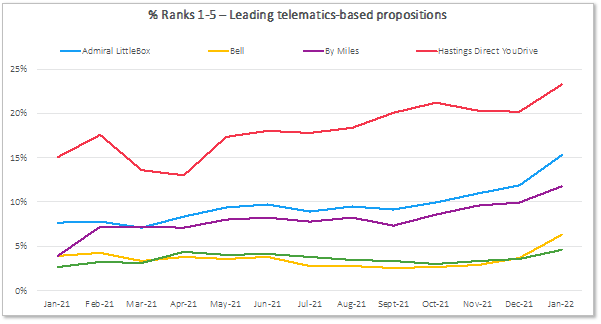

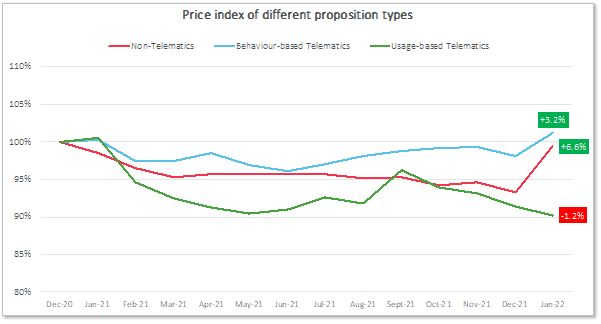

Can the FCA’s latest pricing regulations spark creativity in product development? Peter, December 11, 2023March 7, 2024  Market Response to GIPP  As a period of significant change, the era of GIPP presents a unique opportunity for innovation. However, the most notable innovations we have observed so far have been related to tactical pricing and product packaging by major corporate entities.  In the lead up to GIPP, we witnessed up to nine corporate groups strategically placing three or more motor propositions in the top 5 positions on the PCWs. This resulted in 40% of drivers receiving new quotes seeing at least three competitive prices from the same group. This shift represents a substantial change from what customers were accustomed to seeing a few years ago. It is driven by a combination of industry consolidation, the introduction of product tiering to boost sales, and coordinated pricing strategies among different brands operated by the same broker or insurer. The introduction of product tiers such as bronze, silver, and gold aims to guide consumers towards choosing cover that aligns with their needs. However, this approach raises questions about whether consumers are truly presented with a diverse range of options or if they are selecting from a limited pool of providers offering similar products at close prices. In terms of innovation, telematics products have been gaining traction within the motor insurance sector. Behaviour-based policies targeting younger drivers and usage-based insurance for low mileage drivers are becoming increasingly competitive. Notably, UBI policies were the only proposition type to lower prices in January 2022. The difference between telematics and non-telematics policies has significantly widened post-GIPP, indicating a growing price gap for consumers comparing policies at renewal. This trend is expected to continue, prompting consumers to consider new policy types that previously may have been overlooked. Looking ahead, we anticipate further product and distribution innovations in the insurance market. Brands are exploring flexible home policies, personal cyber cover, and short-term policies to support the sharing economy. Additionally, there is growing interest in parametric insurance among consumers. With the technical aspects of GIPP implementation addressed, brands are now focusing on developing new products to meet evolving consumer demands and align with the upcoming Consumer Duty requirements. Distribution channels are also evolving, with a potential shift from price-focused platforms to value or embedded insurance models. Understanding Market Changes The GIPP Performance Tracker offers insights into market responses to GIPP, enabling businesses to adapt their product offerings and pricing strategies accordingly. The tracker provides data on pricing, competitiveness, product trends, renewals, incentives, add-ons, and premium finance across the insurance market. Find out more about how GIPP is shaping the insurance landscape and influencing consumer behavior. Home insurance