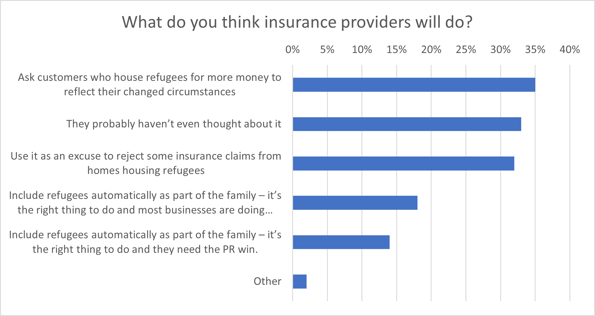

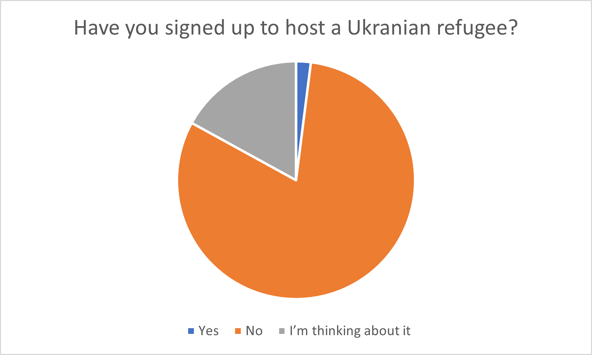

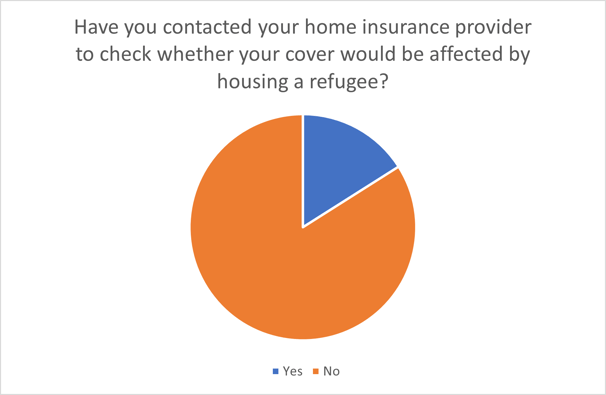

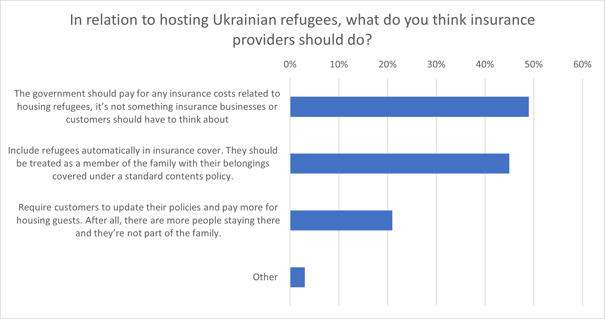

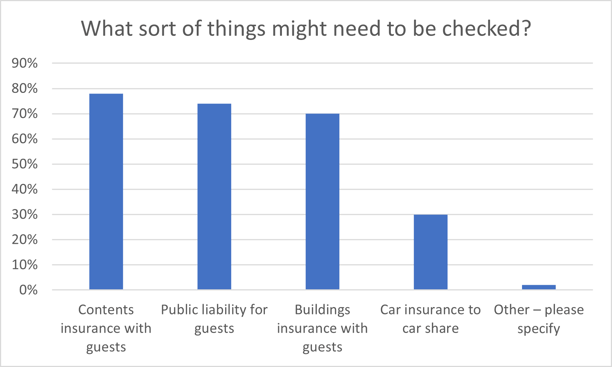

What are the expectations of customers regarding home insurance and Ukrainian refugees? Peter, December 13, 2023March 7, 2024   Government Scheme for Ukrainian Refugees in the UK When the government scheme launched in mid-March, nearly 90,000 people in the UK had offered homes to Ukrainian refugees within the first few hours. Legalities and Insurance Considerations  But how many of those have considered the legalities of opening up their homes and spaces? How many have been in contact with their insurer? And how many insurance firms are proactively clearing the way for them? Viewsbank Survey Results According to our latest Viewsbank survey, nearly 1 in 5 Brits has already signed up or is thinking about housing a Ukrainian refugee. While only 2% have committed, a further 17% are thinking about it – possibly working through some of the logistics. Survey Details: 1,006 online interviews conducted 18 – 20 March 2022  Insurance Implications Of those logistics, checking on the insurance implications seems to have come quite low down the priority list… More than 8 out of 10 (84%) hadn’t made contact with their insurance provider – although once prompted 72% said they planned to do so. Viewsbank Insight Sample Group: 194 people who have signed up to host, or are considering hosting, a Ukrainian refugee Insurance Priorities: Contents insurance, public liability for guests, building insurance, and car insurance Confidence and Concerns Of those who had been in touch with their insurer, 94% felt the information they’d received has been good or very good. But overall confidence in the insurance response was not high. Concerns: Price increases, lack of consideration, rejection of claims Desired Support: Government funding for insurance costs, automatic inclusion of refugees in cover Consumer Intelligence CEO Perspective Consumer Intelligence CEO, Ian Hughes, emphasized the importance of keeping insurers informed and ensuring adequate coverage when hosting refugees. Insurers are urged to be transparent and supportive in addressing customer concerns. Key Points:  Customer Care: Insurers should support customers in navigating insurance policies Responsibility: Providing fair value and assistance to customers is essential About Viewsbank   Viewsbank is our in-house consumer research panel, conducting both quantitative and qualitative research. The panel assists in various projects, aiding clients in making informed decisions based on genuine consumer insights. Home insurance