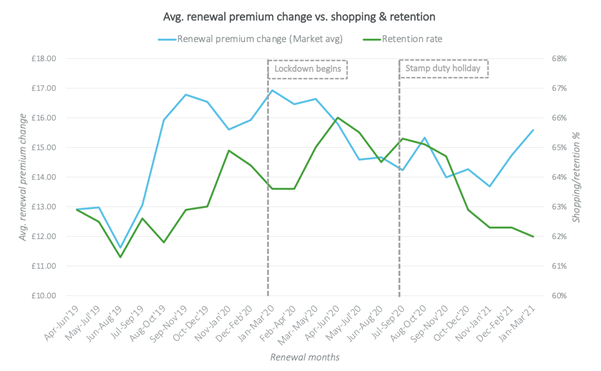

Insurance Churn Caused by House Relocation Peter, January 3, 2024March 7, 2024 Consumer Behavior in the Property and Insurance Market The property market has seen a significant boost due to the race for space and the impact of stamp duty. Homeowners are not only changing postcodes but also switching insurers as they move to larger properties to accommodate remote work and increased demand for garden space.  Renewal rates for home insurance policies have been on the decline since the introduction of a stamp duty holiday last July. With 183,170 property transactions completed in March 2021 alone, the highest on record, consumers are facing changes in risk makeup when they move homes, potentially leading to higher insurance premiums. In addition to moving house, consumers are also facing a widening gap between new business and renewal pricing in the insurance market. While renewal premiums have been rising, new business premiums have been falling due to fierce competition in the market. As the stamp duty holiday expires, consumers are urged to shop around for better deals on buildings and contents policies. Car insurance retention rates have also dropped, with consumers facing increased quotes at renewal despite falling new business rates.  With consumer behavior shifting towards shopping around at renewal, insurance providers are strategizing to attract and retain customers ahead of the dual pricing ban. Understanding consumer behavior during the renewal process is crucial for decision-making and performance monitoring in the insurance market. Enhance decision-making, performance monitoring, and planning by understanding consumer behaviors, attitudes, and intentions at insurance renewal with the Insurance Behavior Tracker (IBT). This comprehensive consumer survey provides insights into market trends and brand performance, enabling informed decisions for robust marketing and business plans. Learn more Home insurance