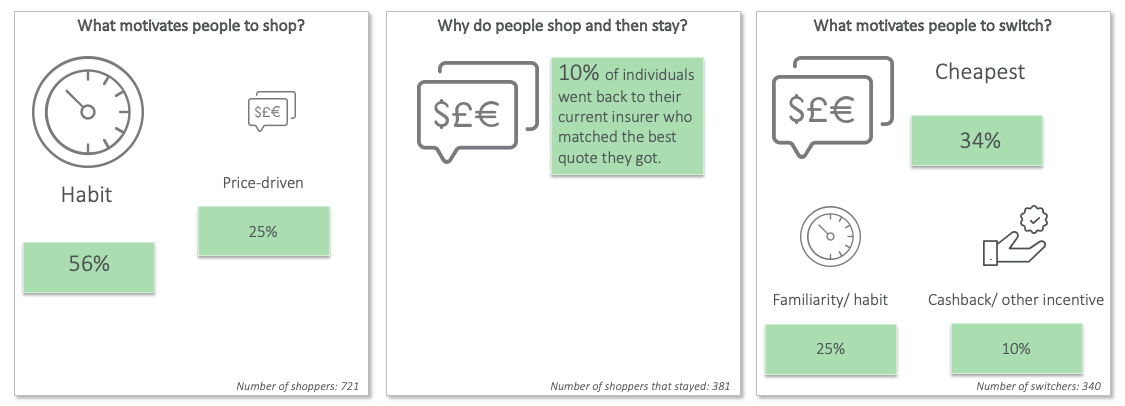

Impact of the cost-of-living crisis on consumer behavior in terms of shopping and switching Peter, November 27, 2023March 7, 2024  Consumer Behaviour Trends in the Cost of Living Shopping around and switching has decreased significantly since the ban on price walking. The introduction of an industry-wide guarantee, enforced by regulators, ensures that existing customers are not charged more than new customers. Home Market Insights In the home insurance market, the percentage of customers shopping around decreased from 76.1% in April-June 2019 to 71.5% in April-June 2022. Similarly, switching dropped from 37.1% to 34.7%. This trend was mirrored in the motor market, with shopping decreasing from 83.1% to 79.4% and switching from 39.7% to 36.9% over the same period. Driving Factors for Shopping and Switching When it comes to home insurance, only 25% of shoppers are motivated by price, while 56% shop out of habit. In contrast, in the motor insurance market, 14% of shoppers are price-driven, with 50% citing the cheapest price as the main reason for switching providers. Future Trends As the cost of living continues to rise, we anticipate an increase in shopping rates. The key question is whether switching rates will also rise, dependent on customers feeling that they are saving money by switching. Providers must focus on communication, value, and customer safety to attract and retain cost-conscious consumers. [September Report] Cost of Living Consumer Behaviour Tracker Monitor changing consumer sentiments, attitudes, and behaviors in the face of rising living costs. Download our free report today! [DOWNLOAD FREE REPORT](link to report) Comment on blog post… Tags: home insurance, motor insurance, pricing, consumer research Like it? Share it: Twitter LinkedIn Facebook Home insurance